Smart Money Workshop develops financial literacy skills in primary, secondary and tertiary students. This workshop allows students to apply financial concepts in an authentic learning space. Through interactive activities, they explore education and career pathways and experience the relationship between financial decisions and long-term well-being.

Our workshop encapsulates relevant, up-to-date current affairs that students will encounter at different stages of their life. At the end of the workshop, they will be able to think critically, make informed decisions and apply their knowledge to real-world situations. Students gain the skills and understanding needed to navigate their financial future, embrace lifelong learning, and adapt confidently to the economy’s changing demands.

Make smart money choices in an authentic learning space.

Identify needs and wants.*

Experience financial needs at various life stages.

Manage loans in a simulated environment.

Learn about investment objectives and the power of compounding.**

Experience investment scams in a safe learning environment.**

Recognise that the economy moves through predictable cycles.**

Develop strategies to navigate times of economic uncertainty with confidence.

Understand the relationship between education and career choices.

Experience how career choices can impact their income potential.

Learn how lifelong learning can protect their financial well-being.

Experience how lifelong learning can improve their career progression.

At the beginning of each session, participants are introduced to core financial literacy concepts, setting the foundation for practical application.

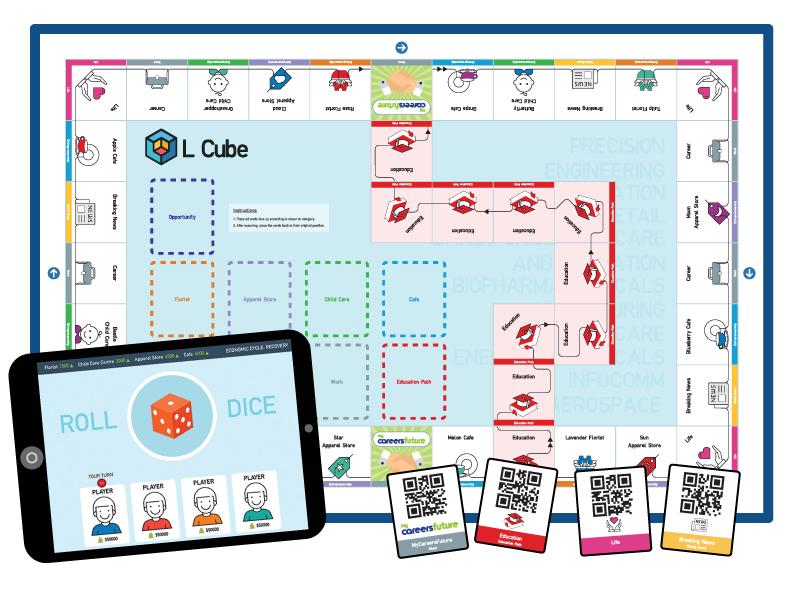

Using our proprietary learning tool, L Cube, they engage in groups of five, either in the classroom or a hall, actively applying these concepts through an interactive, hands-on simulation that strengthens their money management skills. Throughout the experience, participants learn to think critically in challenging situations, adapt to shifting economic conditions, and remain resilient when facing uncertainty.

To wrap up, a debrief reinforces key learning points, ensuring they leave with a clearer understanding of financial concepts and positive habits for managing their money.

This workshop is designed for Primary, Secondary, and Post-Secondary students who are beginning to explore financial responsibility and real-world decision-making. It is available at different levels to suit students with varying financial competency. You may refer to the table below or contact us for recommendations tailored to your students’ needs.

| Smart Money Workshop (Lite) | Smart Money Workshop (Foundation) | Smart Money Workshop (Basic) | HSBC TPsmart Workshop* | Smart Money Workshop (Pro) | |

|---|---|---|---|---|---|

| Education and Career Pathways | |||||

| Lifelong Learning | |||||

| Smart Money Choices | |||||

| Financial Planning | |||||

| Manage Loans | |||||

| Stay resilient | |||||

| Needs and Wants | |||||

| Investment | |||||

| Inflation | |||||

| Money Jar Simulation | |||||

| Gamified E-Learning Platform | |||||

| Activity | Web-based Games | Board Game | Board Game | Board Game | Board Game |

| Suitable for Students | Pri 4 to Sec 2 | Pri 4 to Sec 1 | Sec 1 to Sec 4/5 | Sec 1 to Sec 4/5 | Sec 3 and above |

| Workshop Highlights |

|

|

|

|

|

We use our proprietary board game and learning application to simulate real-world experiences in our financial literacy workshop*. The L Cube board game adds a tech-savvy twist to traditional gameplay, allowing participants to roll dice on the iPad, scan QR codes on cards, and navigate real-world scenarios while having fun. This interactive approach transforms learning into an engaging, hands-on journey toward mastering money management skills.

Our learning materials were developed with support from the Lifelong Learning Council. The Lifelong Learning Council, which consists of private and public sector leaders and was set up by the Skillsfuture Singapore (SSG) and Workforce Singapore (WSG).

* Smart Money Workshop (Foundation, Basic & Pro), HSBC TPsmart Workshop.

Our Gamified E-Learning Platform extends learning beyond the workshop*. Students continue to explore financial literacy through games, quizzes, and challenges that reinforce key concepts and apply what they’ve learned in a fun, interactive way. The web-based platform is designed for seamless integration into self-directed or flipped learning environments.

Our platform blends education and entertainment to create an immersive learning experience. Interactive games and quizzes make financial literacy engaging and help students retain knowledge more effectively. Features such as Leaderboards, Badges, Progress Tracking, and Interactive Exercises motivate students and sustain interest. The platform encourages healthy competition, active participation, and a deeper connection to the content, supporting meaningful learning outcomes.

* Smart Money Workshop (Lite) & HSBC TPsmart Workshop.

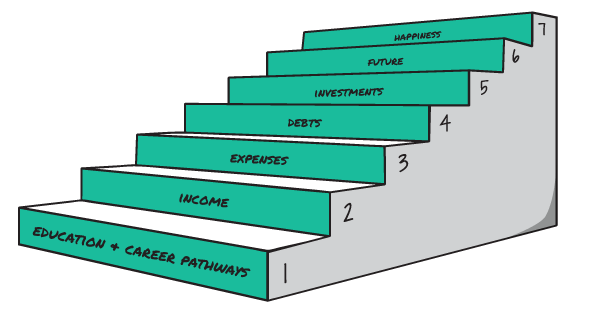

Financial Literacy is the ability to make informed decisions and take decisive actions to manage your money. Having a strong foundation in financial literacy means we are able to take charge of every financial aspect of our life and we do not let money control us. We chart our education & career pathways. We understand and manage our income, expenses, debts and investments. We are in control of our financial future and understand the relationship between money and happiness.

The learning concepts in our Smart Money Workshop is based on the Financial Literacy Book, Take Charge: Be Money Smart in 7 Steps. Students are encouraged to take charge of their finances and plan their career pathways. The book helps them make smarter financial decisions, safeguard their future, increase their income potential, and set meaningful life goals for long-term happiness.

Money savvy, future-ready!

BUY ONLINE

Empower your students to make smarter financial decisions through interactive, gamified learning experiences.

CONTACT USCopyright © 2026 SmartCo.Cloud Pte Ltd.